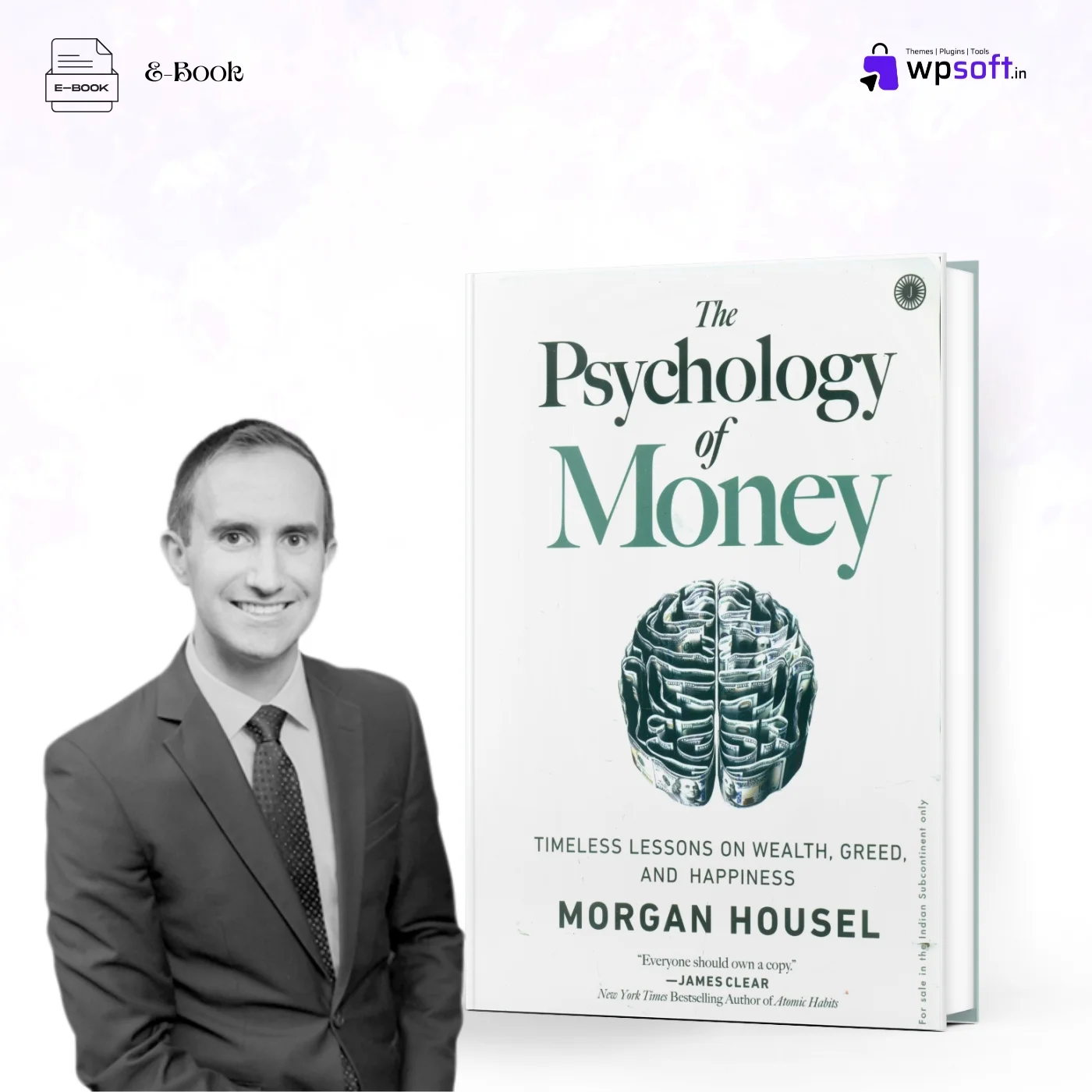

The Psychology of Money: Key Lessons on Wealth, Greed, and Happiness

Money is more than just numbers in a bank account; it’s deeply tied to human emotions and behavior. The Psychology of Money by Morgan Housel dives into the relationship between psychology and financial success. Unlike traditional finance books that focus solely on numbers and strategies, this book emphasizes how people think, make decisions, and react to money.

In this article, we’ll explore key lessons from The Psychology of Money, understand how human behavior affects financial outcomes, and discuss why adopting the right mindset is crucial for wealth-building.

- Instant Access

- Easy to Read E-Book

- Accurate Text

- 253 Pages

Understanding the Core Idea of The Psychology of Money

Morgan Housel presents an important concept: financial success isn’t solely about intelligence or mathematical skills but about behavior and mindset. People often believe that wealth comes from making smart financial decisions, but emotions, experiences, and habits play a bigger role in determining financial well-being.

The book consists of 19 short stories that highlight different aspects of how people perceive money. Each chapter reinforces the idea that financial decision-making is deeply personal and varies based on life experiences rather than just logic.

Key Lessons from The Psychology of Money

Let’s break down some of the most powerful lessons from the book that can transform the way you think about money.

1. Wealth is What You Don’t See

Many people measure wealth by what they own—fancy cars, big houses, and luxury goods. However, Housel argues that true wealth is the money you don’t spend. Saving, investing, and financial security are far more valuable than material possessions. Living below your means and prioritizing long-term stability over short-term gratification is the real secret to financial freedom.

2. The Power of Compounding

One of the most underrated factors in wealth-building is time. Housel highlights how legendary investor Warren Buffett accumulated most of his fortune not just through smart investments but by starting early and allowing compound interest to do its work. The earlier you start saving and investing, the more powerful compounding becomes, leading to exponential growth in wealth.

3. Risk vs. Luck: Understanding Financial Success

People often attribute financial success to intelligence or strategy, but luck and risk play a significant role. Someone who makes a risky investment and becomes wealthy might believe it was due to skill, while another person who followed the same strategy but failed might be considered incompetent. Recognizing the role of luck helps in making more rational and balanced financial decisions.

4. Money Mindset: The Key to Long-Term Wealth

Having the right money mindset is more important than chasing quick gains. Patience, consistency, and emotional control determine financial outcomes more than short-term investment strategies. Housel stresses the importance of financial independence, which comes from stability rather than just making more money.

5. The Importance of Financial Humility

Many financial mistakes come from overconfidence. Housel advises that it’s better to stay humble, avoid unnecessary risks, and prioritize financial safety. No one can predict the future, and the best way to safeguard wealth is through conservative financial planning.

How to Apply These Lessons in Real Life

Understanding these principles is one thing, but applying them is where real change happens. Here are some practical ways to integrate the lessons from The Psychology of Money into your life:

- Start Saving Early: Even small savings can grow significantly over time due to compound interest.

- Live Below Your Means: Avoid lifestyle inflation and focus on financial security.

- Diversify Investments: Don’t put all your money in one place; spread the risk.

- Focus on Consistency Over Perfection: Making steady progress is better than trying to make perfect financial moves.

- Recognize the Role of Luck: Don’t compare your financial journey to others; focus on long-term goals.

Why The Psychology of Money is a Must-Read for Everyone

Whether you’re an investor, entrepreneur, or someone looking to improve personal finances, The Psychology of Money offers invaluable insights. It simplifies complex financial concepts and focuses on human psychology, making it accessible to anyone.

This book isn’t just about money—it’s about life choices, habits, and how emotions impact our financial future. By shifting your mindset and applying the principles in the book, you can achieve long-term financial stability and freedom.

Why Buy from Us?

At WPSoft Marketplace, we ensure that your purchase experience is seamless and reliable:

This database is a powerful tool for businesses to expand their reach, understand their audience, and drive targeted marketing campaigns effectively.

- Instant Delivery: Download your E-Book instantly after purchase.

- Affordable Pricing: Enjoy unbeatable prices on all our products.

- Dedicated Support: Our customer service team is available 24/7 to assist you with any queries.

_____

Frequently Ask Questions

Who is the author of The Psychology of Money?

Morgan Housel is the author of The Psychology of Money. He is a financial writer and partner at Collaborative Fund.

What is the main message of The Psychology of Money?

The book emphasizes that financial success is more about behavior and mindset than intelligence or financial strategies.

Is The Psychology of Money suitable for beginners?

Yes, the book is written in an easy-to-understand manner, making it accessible to both beginners and experienced investors.

How can I apply the lessons from this book in my daily life?

You can apply the lessons by practicing financial discipline, focusing on long-term wealth-building, and avoiding impulsive financial decisions.

Where can I buy The Psychology of Money?

The book is available on WPSoft Marketplace, bookstores, and online e-commerce platforms.

Reviews

There are no reviews yet.